How To Set Up IVR Fee With out Storing Credit score Card Knowledge

[ad_1]

Interactive Voice Response (IVR) funds enable clients to deal with purchases and pay payments by interacting with an automatic system.

This implies your clients now not need to undergo the awkward second of studying their card particulars out loud to one in every of your service brokers. In flip, your staff also can transfer on to take care of extra urgent points when you get pleasure from the advantages of a more healthy work setting and elevated buyer satisfaction—most often.

In some circumstances, IVR methods generally is a goal for hackers resulting from how they acquire and retailer buyer information like bank card particulars. Consequently, there’s a maze of compliance rules it’s a must to fulfill to have an IVR fee system in place.

Certain, it requires some further work, however in the long run, it may be effectively price it—each for you and your clients.

Why Prospects Love an IVR Fee Choice

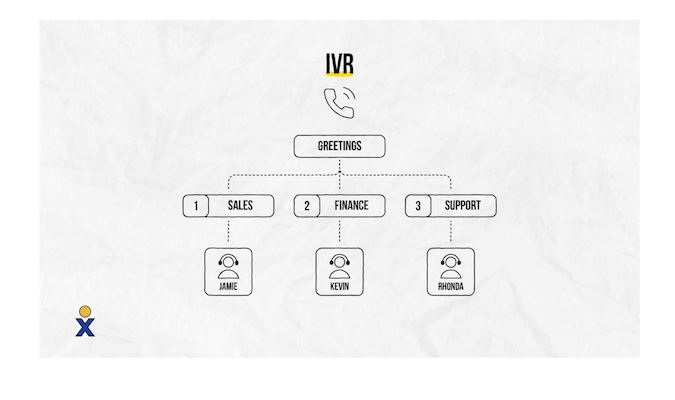

Consider IVR as an auto-attendant on steroids. If common auto-attendants carry out fundamental duties, like routing calls or taking part in messages, IVR methods hyperlink to info databases.

As such, IVRs can reply questions, retailer buyer habits information, and naturally, deal with funds. These are simply a few of the ways in which make IVRs so widespread amongst VoIP service suppliers.

IVRs additionally include quite a few advantages on the enterprise facet of issues, like decreasing customer support prices and worker turnover charges. However clients love this method as effectively, particularly in the case of funds.

Right here’s why:

- Self-service funds: Prospects could make funds with the IVR alone, so there’s no have to share bank card particulars with a reside agent. This makes the transaction course of extra snug.

- Comfort: Prospects could make funds 24/7/365. They don’t have to attend on maintain for an agent or be time-restricted by customer support working hours.

- Error-free transactions: Since IVR funds are automated, they remove many of the dangers of clerical errors that include guide information entry.

- Safety: IVR fee methods should be PCI DSS (Fee Card Trade Knowledge Safety Commonplace) compliant. This ensures that IVR fee methods undergo a rigorous course of to reveal that delicate buyer information is extremely safe.

- Accessibility: IRV fee methods provide multilingual menu choices, that are excellent for minimizing communication errors and serving a world buyer base.

IVR fee methods will be agent-assisted or self-serviced. Agent-assisted methods require clients to speak to a gross sales agent who will information them by the transaction course of.

Nonetheless, brokers don’t have entry to the shopper’s bank card particulars on this case—they only see whether or not the transaction was declined or accredited, together with authorization codes. With self-service methods, clients work together instantly with the IVR system, bypassing service brokers altogether.

Compliance Challenges with IVR Funds

As talked about, IVR funds have to undergo a rigorous PCI DSS compliance course of.

PCI DSS is a set of technical and operational requirements mandated by bank card corporations like VISA, Mastercard, and American Categorical. Any enterprise that handles bank card funds has to comply with these requirements to deal with transactions and information securely.

There are 12 steps and/or pointers to this course of:

- Set up and keep firewalls: Firewalls act as a primary line of protection towards potential cyberattacks as they limit visitors coming to and out of your community.

- Don’t use vendor-supplied defaults for passwords and different parameters: Default community and system safety settings are simply exploited. Altering them with customized passwords is necessary.

- Defend saved buyer information: Set up correct information storage and retention insurance policies. Cardholder information must be saved for as little time as doable and purged usually.

- Encrypt cardholder information transmission: Any information switch throughout public networks (reminiscent of web, Bluetooth, satellite tv for pc comms, and VoIP telephone networks), requires strong safety protocols and cryptography to make sure cardholder information safety.

- Use and replace antivirus software program: Antiviruses are necessary and should be up to date usually throughout each system that handles cardholder information.

- Develop and keep safe apps and methods: Any in-house or third-party software program software must be checked for safety vulnerabilities and patched if any points are found.

- Check safety methods periodically: Usually check system community, software program, and element safety.

- Develop a safety coverage: Develop and keep a safety coverage that features a doc threat evaluation course of, know-how utilization insurance policies, an incident response plan for system breaches, a proper consciousness program, and a safety duty definition for all personnel.

- Monitor entry to cardholder information and community sources: Use logging mechanisms to trace cardholder and community entry. The audit path historical past must be saved for no less than a 12 months.

- Limit bodily entry to cardholder info: Bodily entry to cardholder info—or methods that work together with it—should be restricted to make sure information integrity.

- Solely share cardholder info on a need-to-know foundation: Give approved staff simply sufficient cardholder info to satisfy their duties—nothing extra.

- Assign a novel ID/IP handle to every consumer: Restrict personnel entry based mostly on their particular person permissions and keep audit trails.

Remember that every step or guideline is only a module and that every module has its personal particular subset of necessities that need to be met. In complete, there are over 200 gadgets on the complete guidelines.

Sure, which will sound daunting, but when your IVR fee system just isn’t PCI DSS compliant, you could face fines anyplace from $5,000 to $50,000 from bank card corporations—and people are month-to-month fines.

Other than fines, you might also face blemishes to your fame and buyer lawsuits that come after an information breach. Take the British Airways breach from 2019, for instance.

Now, all of that being mentioned, should you don’t wish to take care of the trouble of dealing with bank card information, however you continue to wish to provide IVR fee capabilities to your clients, you may at all times outsource it.

Outsourcing IVR Funds to Lower Compliance Complications

Given the hurdles introduced on by PCI DSS compliance, many entrepreneurs have jumped in to tackle these challenges for you as a service—similar to you’ll rent another person to do your organization taxes.

In the present day, many IVR fee system suppliers have already got the necessities in verify, and you may consider them because the IVR model of Level-of-Sale (POS) suppliers. All it’s a must to do is combine your current IVR or name middle software program inside their system. Your clients will robotically be routed to your supplier’s fee system, guaranteeing a seamless transaction course of.

When buyer bank card transactions are made by your supplier’s system, you don’t need to take care of cardholder information or PCI compliance. Moreover, IVR fee companies are typically out there from corporations that additionally provide pay-by-link, net fee, and fee gateway options.

That mentioned, there are some issues to bear in mind once you’re available in the market for an outsourced IVR fee supplier.

Issues to Contemplate When Selecting an IVR Fee System

PCI DSS Degree 1 certification

PCI DSS compliance is break up into 4 ranges categorized by the variety of bank card transactions an organization handles per 12 months.

For example, PCI Degree 4 is for companies that course of fewer than 20,000 transactions per 12 months, whereas PCI Degree 1 is given to corporations that course of over 6 million transactions annually. Necessary safety measures differ from stage to stage.

Nonetheless, since PCI Degree 1 offers with the biggest quantity of transactions, it additionally comes with the strictest necessities—which is why you could wish to prioritize suppliers at this stage.

Among the PCI Degree 1 necessities embrace an annual on-site audit by an inside safety assessor (ISA) or certified safety assessor (QSA), a quarterly community vulnerability scan carried out by an accredited vendor, and no less than an annual cybersecurity penetration check.

Additionally, be looking out for extra certificates like NACHA and HIPAA to make sure your IVR supplier’s safety measures are suitable along with your business and may deal with US digital bank-to-bank funds.

System integrations and scalability

Maintain a watch out for IVR fee options that combine along with your current software program, like accounting, ecommerce, CRM, and VoIP options.

This ensures you may keep operational earlier than and after implementing the IVR fee system with none hiccups. Some IVR fee suppliers additionally provide customized integrations by APIs—which is great for scalability.

Equally, it’s a good suggestion to think about IVR fee suppliers that help you add extra options if wanted, like name transcripts and the choice to deal with omnichannel funds.

Customization

Since IVR funds are all about making your clients glad, your supplier ought to provide broad customization capabilities. The choice to customise your fee choices and automatic prompts is essential for enhancing the shopper expertise.

In the meantime, personalised welcome messages and bill templates help you maintain issues on-brand. Some IVR fee options even facilitate drag-and-drop customization, so search for that if it’s one thing that might make your life simpler.

Conclusion

Total, IVR fee outsourcing can do wonders on your firm. It offers customer support brokers time to deal with extra necessary points, whereas your clients can deal with funds rapidly with out worrying if their information is in danger.

Most significantly, it spares you from the migraines that include PCI compliance, so contemplate giving it a shot. That mentioned, do your due diligence and ensure your IVR supplier of selection fulfills the standards you want it to.

[ad_2]

Source_link