How To Measure Buyer Acquisition Price [with Examples]

[ad_1]

Doing common advertising and marketing actions could be a main expense for any firm. It’s not simply the price of paid actions, but in addition day-to-day bills like operational prices and utilizing advertising and marketing instruments.

However how will you make certain that you’re utilizing your cash properly? Properly, there’s a neat little metric that aligns intently along with your advertising and marketing efforts. It’s referred to as the Buyer Acquisition Price. Should you’re questioning tips on how to measure it and, extra importantly, tips on how to scale back it, this text is for you.

Learn on to learn to measure the effectiveness of your operations precisely!

What’s buyer acquisition price (CAC)?

Let’s begin with the essential definition of CAC.

Buyer Acquisition Price (CAC) is the entire quantity that firms spend to get new prospects. This contains the prices of promoting campaigns, worker prices, software program prices, and all the opposite components vital for getting a buyer.

CAC helps firms work out the price incurred for every new buyer they achieve over a selected time vary; for instance, a 12 months or a monetary quarter.

CAC can present some fairly worthwhile insights into your organization’s operational effectivity. It might probably even reveal the worth derived out of your funding in buyer acquisition.

The underside line? This metric is the usual for benchmarking the effectivity of your advertising and marketing and gross sales efforts.

How you can calculate buyer acquisition price (CAC)?

To find out your Buyer Acquisition Price (CAC), it’s good to divide the entire advertising and marketing bills by the variety of prospects you acquired throughout a selected interval.

At its easiest, the components is:

CAC = advertising and marketing bills / acquired prospects

You completely should embrace all associated bills, together with employees salaries related to advertising and marketing campaigns, software program prices, consultancy charges, and some other associated overheads.

Let’s illustrate this utilizing an instance of attainable month-to-month bills on advertising and marketing:

| Expense | Price | Amount | Quantity spent |

| Advertising and marketing Software program | |||

| SE Rating search engine optimisation platform | $87 | 1 | $87 |

| Electronic mail advertising and marketing platform | $20 | 1 | $20 |

| Outreach platform | $120 | 1 | $120 |

| Social media and model monitoring | $80 | 1 | $80 |

| Promoting (CPC) | |||

| Google Adverts | $1.50 | 2,000 | $3,000 |

| Fb Adverts | $2.2 | 10,400 | $22,880 |

| LinkedIn Adverts | $19.3 | 850 | $16,405 |

| PR actions | |||

| PR marketing campaign | $1,500 | 1 | $1,500 |

| Occasion sponsorship | $7,500 | 1 | $7,500 |

| Progress | |||

| search engine optimisation coaching | $750 | 1 | $750 |

| Advertising and marketing convention | $250 | 1 | $250 |

| Consultancy charges | $500 | 1 | $500 |

| Salaries | |||

| Advertising and marketing Supervisor | $5,000 | 1 | $5,000 |

| search engine optimisation Supervisor | $5,000 | 1 | $5,000 |

| Content material Author | $5,000 | 2 | $10,000 |

| Graphic Designer | $5,000 | 1 | $5,000 |

| Freelance providers | $1,000 | 3 | $3,000 |

| Complete: | $81,092 | ||

| Variety of new prospects: | 500 | ||

| CAC: | 81,092 ÷ 500 = 162 | ||

Within the instance above, the corporate spends $162 on common to amass every new buyer throughout all advertising and marketing channels.

What is an efficient buyer acquisition price?

Questioning how to determine in case your calculated end result aligns with market requirements? Properly, there’s no definitive reply or a universally accepted gold normal. All the pieces right here hinges on the specifics of your small business and the business you’re working in.

As an example, one Gartner report said that the common CAC for expertise firms with annual revenues underneath $250 million stands at $27,000. At first look, this may appear steep. However contemplate that prospects like these may very simply purchase an answer price hundreds of thousands of {dollars}.

Let’s distinction this with an e-commerce firm within the meals and beverage sector, the place the common CAC is simply $53.

To shed some mild on the extent of those variations, listed below are some different CAC benchmarks from numerous industries:

- Automotive: $592

- B2B SaaS: $239

- Enterprise Consulting: $533

- Authorized Providers: $749

- eCommerce: $86

- IT & Managed Providers: $454

- Pharmaceutical: $187

- Transportation & Logistics: $510

- Manufacturing: $723

It’s worthwhile to discover them, however do not forget that each firm has its distinctive operational nuances. Your main reference ought to be your individual historic information and a want to attain the bottom attainable determine.

Methods for extra complete CAC evaluation

Whereas we already highlighted that CAC is usually calculated from the cumulative prices of buying prospects from all advertising and marketing channels, it’s versatile sufficient a metric for different analyses.

Evaluation of particular advertising and marketing actions

As an example, you’ll be able to decide the CAC exactly for particular advertising and marketing efforts akin to search engine optimisation. On this case, you must embrace bills akin to search engine optimisation and outreach device prices, salaries for search engine optimisation managers and content material writers, consultancy charges, and different associated search engine optimisation bills. In case your workforce bought a paid search engine optimisation course or attended an search engine optimisation convention throughout this era, these bills also needs to be counted.

Typically your CAC calculations for search engine optimisation may be inaccurate. That is due to the particular nature of this advertising and marketing channel. Not all of your search engine optimisation efforts will repay instantly, and within the present month, you might witness outcomes influenced by investments made in earlier months.

Evaluation of particular person buyer segments

You too can analyze CAC by buyer segmentation. See the examples under:

- Preliminary CAC: The bills required for buying a brand new buyer for the primary time.

- Renewal CAC: The monetary dedication vital to make sure a buyer continues their cooperation (for instance, they could purchase a license for the subsequent month or proceed to make use of your providers).

- Reactivation CAC: The cash invested in re-engaging a buyer, particularly one who may need beforehand discontinued your providers.

- Market CAC: The price of buyer acquisition from a selected geographical or business phase.

- Product CAC: The prices instantly related to attracting prospects for a definite product providing.

- Finish customers CAC: Buyer acquisition price primarily based on the variety of precise customers, not the variety of prospects. For instance, in the event you promote software program, one firm may buy a number of licenses for a number of particular person customers.

What’s the relation between CAC and CLV?

Typically, when calculating CAC, it will possibly really feel like your aspirations for buyer acquisition are too excessive or that your advertising and marketing efforts aren’t absolutely paying off. However have you ever thought of that your prospects may purchase from you greater than as soon as? That is particularly essential for e-commerce firms, which promote merchandise that individuals purchase repeatedly, like meals, cosmetics, clothes, and so forth.

That is the place one other metric, Buyer Lifetime Worth, performs an important function.

Buyer Lifetime Worth (CLV) captures the entire income a enterprise can count on from a single buyer all through their tenure as a purchaser.

So, what’s the distinction between CLV and CAC?

CAC represents the corporate’s funding into gaining a brand new buyer, which is made up of promoting and associated prices. CLV offers a projection of the entire income a enterprise can moderately count on from a single buyer all through their shopping for relationship.

Think about you’ve simply opened a espresso store. To encourage individuals to come back in and take a look at your espresso, you’ve invested in numerous advertising and marketing actions. This contains colourful flyers distributed all through the neighborhood, sponsored social media adverts, native search engine optimisation, and extra.

Now let’s mix the prices of those campaigns. Let’s say you spend $5 for each new buyer that walks by your door. This $5 is your Buyer Acquisition Price (CAC).

Right here’s the place the magic begins. As soon as individuals start tasting your trademark espresso, the overwhelming majority of them are smitten. Over a 12 months, let’s say that one in every of your common prospects spends $200 on espresso, snacks, and pastries. That complete annual spend is their Buyer Lifetime Worth (CLV).

This instance clearly illustrates the basic precept of enterprise profitability. That’s, your CAC ought to all the time be lower than your CLV. Should you’re investing $5 in advertising and marketing to usher in a brand new buyer, and that buyer finally spends $200 over time, you’ve achieved a hefty return in your preliminary funding.

Why is measuring CAC necessary for your small business?

Buyer Acquisition Price is a metric that, when exactly measured, might help information the success of your small business. Should you’re nonetheless unsure how related it’s to your small business, listed below are 4 pivotal facets to think about:

1. Information-driven selections

CAC provides concrete information, guiding companies in the direction of knowledgeable and strategic selections. Suppose the CAC of your advertising and marketing efforts was surprisingly excessive final quarter. What’s the most exact approach to analyze what went mistaken? One smart means could be to calculate CAC for every advertising and marketing exercise individually (identical to the search engine optimisation prices we talked about above), after which discover out which exercise was much less worthwhile.

If any of those actions resulted in a noticeably increased CAC and also you’re capturing for the bottom attainable price, you could contemplate future actions rigorously. You may wish to drop actions with a excessive CAC and commit extra effort to ones that yield higher outcomes.

2. Enhanced return on funding (ROI)

By being exact, repeatedly assessing, and strategically aiming to decrease CAC, you stand a a lot better probability at boosting your ROI. This course of extends nicely past cost-saving. Effectivity can be a significant factor. Recognizing and harnessing essentially the most cost-effective buyer acquisition strategies does extra than simply result in prudent monetary useful resource conservation. It additionally pivots advertising and marketing methods within the path of channels that promise — and ship — essentially the most strong returns.

3. Sturdy bargaining device for advertising and marketing groups

CAC could be a pivotal level of dialogue between the advertising and marketing division and higher administration.

Think about being a advertising and marketing division head in an organization attempting to navigate by a disaster. Whereas that is taking place, the chief workforce may heighten their buyer acquisition expectations from the advertising and marketing workforce whereas slashing the advertising and marketing price range. Arming your self with concrete information means precisely homing in on and presenting the CAC. This empowers you to barter successfully. It additionally helps you present the exact sources required to attain the specified buyer acquisition targets

4. Beneficial perception for traders

Traders usually resort to CAC. It’s thought of throughout the board as a trusted metric for gauging an organization’s well being and potential for development. By inspecting CAC, traders can discern the depth and high quality of a enterprise’s current buyer relationships. They’ll dig into the nitty gritty of those numbers to seek out out if the corporate already has a ok system for buyer acquisition. Merely put, with extra concrete information, traders could make extra knowledgeable funding selections.

Three confirmed methods to cut back the client acquisition price

1. Improve buyer satisfaction to promote them extra

Among the finest methods to enhance CAC is by cultivating loyalty amongst current prospects. To get loyal prospects, conduct common satisfaction surveys to grasp their expectations and wishes.

You must regulate your choices primarily based on this suggestions. Membership applications that provide reductions to frequent prospects can be efficient. A notable instance is “Starbucks Rewards,” which provides members particular perks and reductions. Impressively, Starbucks’ present variety of program members is about 29 million, they usually account for about 50% of the corporate’s gross sales.

Don’t neglect to run PPC campaigns that concentrate on your current prospects. It is a nice approach to remind them about your organization, and even encourage them to study extra about your new merchandise. PPC campaigns are positive to be a profitable funding, particularly contemplating that the possibility of promoting to an current buyer is far increased (between 60-70%) than promoting to a brand new potential buyer (between 5-20%).

Constructing loyalty not solely encourages prospects to buy extra often but in addition makes them extra more likely to go for higher-tier packages or premium merchandise.

This technique enhances CLV and does nicely to decrease your general CAC and maximize the ROI on every buyer acquired.

2. Enhance web site conversion charges to optimize visitors worth

Boosting your website’s conversion charges is crucial to maximizing the worth derived from your present web site visitors. Leveraging instruments like Google Analytics may be invaluable. These instruments make it attainable to observe particular consumer actions and spotlight essential metrics; notably buying cart abandonment charges. Doing a deep dive into this information can reveal insights about your touchdown pages’ effectiveness, together with its capacity to attract in guests and immediate them to discover additional.

When optimizing your pages, be sure to cater to the fundamentals: quick loading pace, responsive mobile-friendly format, and safe encryption protocol. All of those mixed create a constructive web page expertise, which impacts each your natural rankings and conversion fee. Pages which are a trouble to work together with pressure customers to depart earlier than participating along with your web page copy, so be proactive about fixing any important technical points on the web page. Devoted instruments like SE Rating’s Web site Audit might help you just do that.

Run a/b checks to see how minor (or main!) tweaks within the textual content copy or web page format impression conversions. When analyzing information, take note of all of the important metrics for your small business. Your middleman conversion fee might improve, but when the customers you deliver on board don’t turn into your prospects over time, it received’t assist your CAC. If so, preserve experimenting. Additionally, when revamping a web page copy, thoughts the dangers related to shedding natural visitors each time serps dislike the modifications made. If this occurs (and natural search is a serious supply of visitors you depend on), be able to undo all of the modifications.

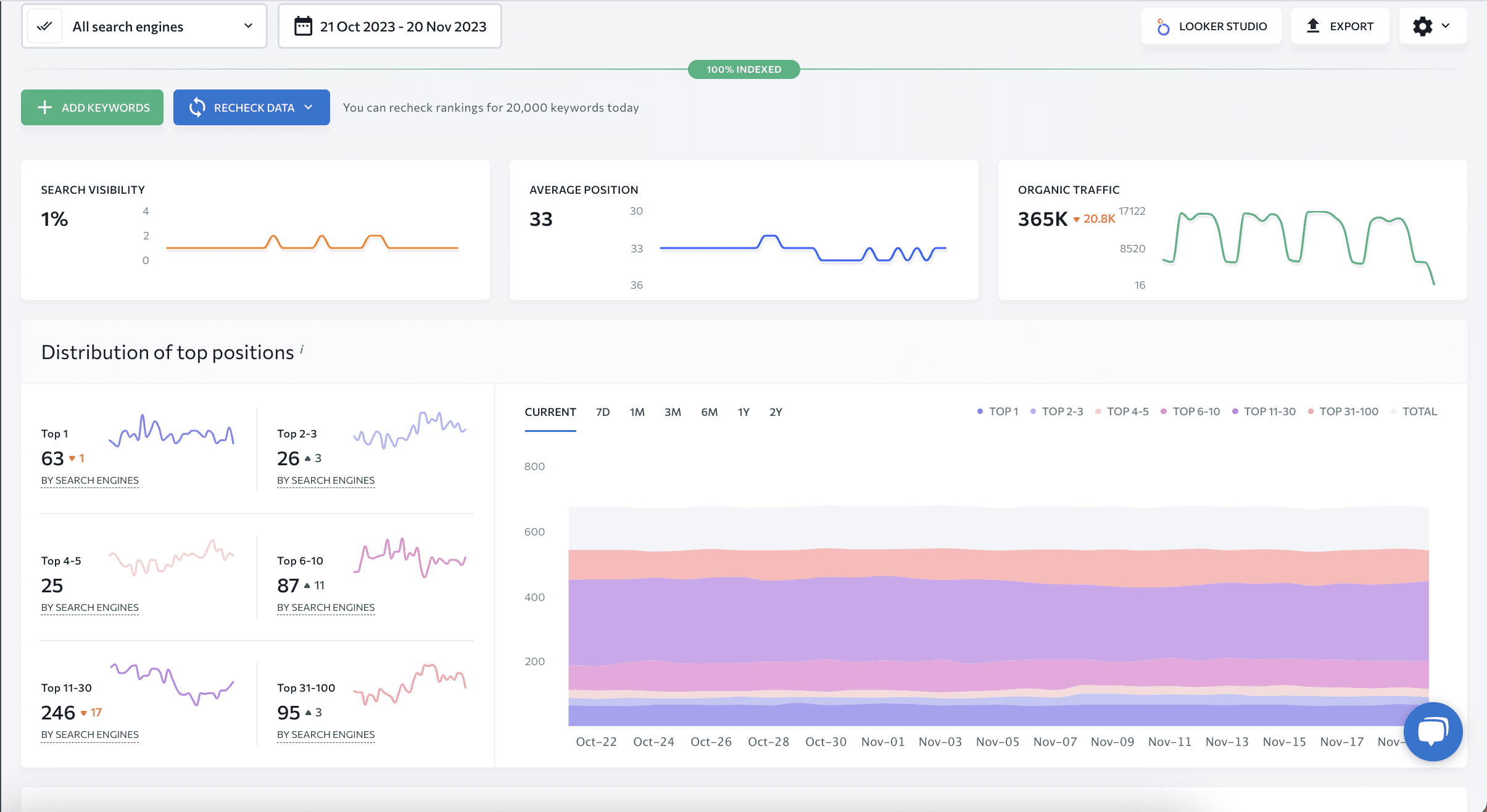

You may sync GA with SE Rating to trace all important metrics on a single dashboard. Additionally, SE Rating’s Rank Tracker helps you to do deeper analysis and helps you see the precise key phrases that misplaced their top-ranking positions.

3. Rigorously analyze buyer information

Do not forget that gross sales is an important a part of advertising and marketing, not clicks or views. Now, suppose you wish to consider the effectiveness of your search engine optimisation efforts for an IT firm. Instruments like Google Analytics, Google Search Console, and SE Rating might help you single out pages getting essentially the most views or how they rank in search.

However you may discover that your hottest pages appeal to primarily IT college students who wish to enhance their programming abilities. This is a matter since you’re attempting to reel in prospects on the lookout for help from an IT firm.

By supporting natural visitors data with extra information in your prospects in a centralized information warehouse or CRM, you’ll be able to see which pages are providing you with essentially the most certified leads, and which contribute to your CAC rating.

CRM methods or information warehouses are highly effective as a result of they permit firms to do all types of necessary duties. This implies monitoring prospects, combining metrics from a number of sources, monitoring their journey by the advertising and marketing funnel, and recording their buying patterns. This wealth of knowledge deepens your understanding of every buyer’s interplay along with your model. It additionally helps you optimize your web site and craft expertly focused promoting campaigns.

Essential components impacting buyer acquisition price (CAC)

When analyzing CAC, perceive that it will possibly fluctuate primarily based on the scenario at hand.

- Firm age: New firms usually face increased CACs on account of upfront advertising and marketing investments and the time wanted to ascertain a foothold. However it’s nonetheless necessary to grasp that preliminary investments are a key a part of your organization’s development. This lends itself to the truth that CAC ought to be evaluated by its potential long-term (by no means short-term) returns.

- Growth into New Markets: Even seasoned manufacturers can see an uptick in CAC, particularly when branching into new markets. That is when it should take time for the fitting advertising and marketing actions to generate loyal prospects.

- Seasonality: If your organization sells swimwear in Europe, as an example, CAC will clearly be decrease in the summertime than within the winter. Conversely, in the event you promote winter jackets, CAC will most likely be decrease within the winter. One attention-grabbing case is B2B firms, the place CAC usually will increase through the summer time season on account of trip intervals. Due to this, many finest practices counsel that evaluating outcomes from the identical interval within the earlier 12 months is extra insightful than contrasting particular person quarterly outcomes.

- Financial scenario: If the scenario in your business has deteriorated, you shouldn’t count on your CAC to lower. One good instance of that is the disaster within the expertise market, which has led to many layoffs. In accordance with The Challenger Report, in 2022, the tech business elevated layoffs by 649%! That is the very best determine in a number of a long time. It’s an alarming instance of why adapting to the present market circumstances is paramount, to say the least. You should set objectives you could realistically obtain out there.

- Unexpected Occasions: Occasions like pure disasters, financial downturns, or international pandemics can have an unforeseeable impression on CAC. Many firms from sectors akin to tourism, gastronomy, or hospitality skilled this through the current COVID-19 pandemic.

The takeaway? Do not forget that the next CAC doesn’t essentially point out an inefficient advertising and marketing division; quite a few exterior components can affect it. That’s why it’s good to monitor market circumstances on a daily and set lifelike aims. That is the way you type a balanced perspective somewhat than narrowly specializing in numbers.

Conclusion

Many firms fail as a result of they don’t have a agency grasp on the assorted prices of getting a brand new buyer.

We hope this text has helped you see the significance of CAC and CLV in measuring advertising and marketing success. While you pay shut consideration to this metric and analyze it properly, the method of rising your small business turns into extra easy and manageable.

[ad_2]

Source_link