Billdu Overview – The Good and Unhealthy for 2023

[ad_1]

When working a small enterprise, accumulating well timed funds is your lifeblood. Producing invoices takes loads of time. Even worse, prospects might find yourself delaying fee in case your invoicing system is just too difficult or poorly designed.

Billdu is an easy-to-use invoicing app that makes an attempt that can assist you obtain funds quicker. It enables you to monitor invoicing, fee schedules, and your bills so that you all the time know the place you stand. On this overview, we’ll let you understand all about it.

Billdu: The Good and the Unhealthy

Billdu has fairly a number of causes to be intrigued by it, headlined by its ease of use, challenge estimate era, and extra. Nonetheless, it’s not going to be the right alternative for everybody given its restricted design choices and lack of superior options.

What Billdu Is Good At

Sensible free trial interval: You may take a look at any of the three pay tiers on Billdu for a full 30 days earlier than you determine to pay.

Having such a protracted trial interval is good for invoicing software program, the place you could solely ship out invoices as soon as a month.

Moreover, you do not need to offer a fee methodology on the time you join the free trial. Since Billdu doesn’t have your fee info, it could possibly’t robotically cost you except you determine to subscribe.

Preferrred for freelancers: When working alone, you don’t have loads of time to chase down prospects for funds. Billdu streamlines the bill era course of, making it straightforward for freelancers on the transfer.

Billdu means that you can provide rapid fee choices for purchasers, to allow them to pay by clicking a hyperlink within the bill to providers like PayPal and Stripe. This will improve the probabilities of receiving a fast fee.

Though the invoices that Billdu generates have easy designs, they’re skilled and extremely organized. Utilizing them, you may give an impression of getting an accounting division on workers, showing extra assured to prospects.

Making a primary on-line retailer: As your small enterprise grows, Billdu might help you promote merchandise on-line with a quite simple on-line retailer.

It means that you can simply embed the shop in your present web site with a hyperlink. You may even settle for funds by means of the web retailer in Billdu.

This on-line retailer lets prospects make appointments and bookings, which is ideal if your enterprise focuses on offering digital providers. Setup is intuitive and straightforward to finish.

Generate challenge estimates rapidly: If, alternatively, you’re employed in an business the place prospects anticipate you to generate estimates when bidding for tasks, Billdu has the instruments that can assist you ship estimates straight to your buyer’s inbox in a well timed method.

It comes with a collection of estimate templates, making it straightforward to specify pertinent knowledge factors. Select a colour scheme and add your enterprise brand. Ought to the client settle for your bid, you may flip the estimate into an bill when the challenge finishes with out re-entering knowledge.

Helpful cell app: Billdu’s builders actually centered on the cell expertise with their software program. You may simply handle all points of Billdu out of your cell machine, together with bill era and expense monitoring.

If a buyer calls and desires a job estimate or one other copy of your bill, ship it instantly out of your smartphone. You may entry all your enterprise’ monetary knowledge everytime you want it, too.

Billdu works properly by means of a smartphone app as a result of it focuses on streamlined invoicing and expense monitoring. It doesn’t have loads of additional options bogging it down.

Sturdy expense monitoring characteristic: You should utilize Billdu to assist with each invoicing and bills, making it straightforward to see the place your cash goes all on one platform.

It types bills by class, challenge, or time interval. You may then evaluate your bills on a specific challenge to the earnings you acquired.

Ought to you’ve upcoming payments due, you may see them in Billdu. Or handle your money circulation whilst you await earnings from upcoming invoices. Plus, it comes with a receipt scanner so that you don’t must decipher crumpled paper receipts when it’s earnings tax time.

Billdu’s Potential Drawbacks

Restricted invoicing design choices: Though Billdu means that you can add your personal brand and customized components to your invoices, you’re restricted in relation to customizing templates. You may’t actually construct your personal templates, both.

It’s tough to manage the dimensions or positioning of your brand on a template, however you may choose a colour scheme and add particular notes.

Having mentioned that, Billdu offers an area for all the primary info you want for an correct bill, together with:

- Your contact info

- Your buyer’s contact info

- Supply date of the objects on the bill

- Value per merchandise

- Tax price

- A number of foreign money choices

- Bill due date

Fewer superior options for giant companies: Bigger organizations that want custom-made options for invoices and bills might discover Billdu doesn’t fairly meet your necessities. It caters extra to small companies and freelancers as a result of it focuses on delivering the necessities.

A few of Billdu’s rivals provide superior options like stock monitoring, which isn’t obtainable at current. Such rivals include larger subscription prices as properly.

Preliminary setup is time-consuming: The setup course of was surprisingly difficult on Billdu. Don’t anticipate to begin the free trial and ship invoices inside a couple of minutes.

After all, you could not thoughts having an in depth setup course of from the leap. You don’t need to cease and add extra info every time you need to entry a brand new characteristic, in spite of everything.

All the identical, you must add fairly a little bit of details about your enterprise earlier than you may start utilizing the app. If you’re utilizing one of many extra superior pricing tiers with detailed monitoring, setup takes even longer.

Billdu Plans and Pricing

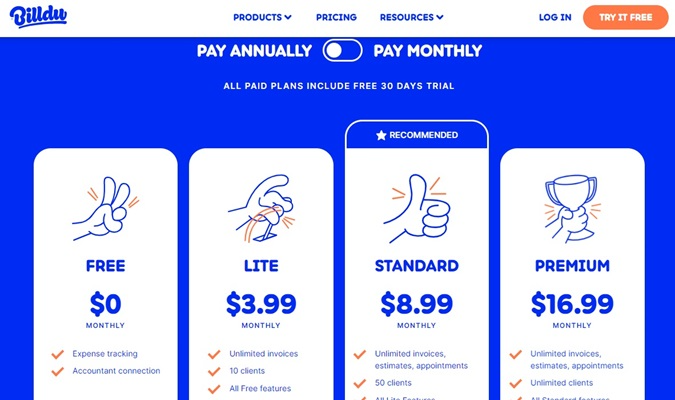

Billdu has three distinct pricing tiers, plus a free providing. Pay on a month-by-month foundation or yearly. When you pay for the entire yr up entrance, you obtain a reduction.

Every of the tiers can help you strive them free of charge for 30 days. You don’t want to offer a bank card to utilize the free trial, both, which is a pleasant characteristic.

Free

This tier is all the time free to make use of, though this can be very restricted by way of its characteristic set. You can’t generate invoices, for instance, that means it in all probability received’t attraction to nearly all of potential customers.

At this degree, you may monitor an infinite variety of bills whereas additionally giving your accountant entry to your Billdu account. It solely permits one particular person—apart from the accountant—to make use of the subscription.

Lite

At this degree, you may submit and monitor an infinite variety of invoices for as many as 10 completely different purchasers. The Lite tier prices $5.99 per 30 days, or you may pay $47.88 for the whole yr, a 33% low cost.

You get each characteristic from the Free tier, to be used for one consumer in your workforce.

Customary

For $11.99 month-by-month or $107.88 yearly—a 25% low cost—the Customary tier is ideal for a small enterprise that should generate value quotes for purchasers.

You don’t have any limits in expense monitoring, bill era, or value quote era at this degree. Plus, you may submit invoices for as much as 50 completely different purchasers and join as much as two members of your workforce alongside along with your accountant.

Along with the bill standing monitoring discovered within the Lite tier, you may submit fee reminders and fee receipts within the Customary tier.

Premium

The Premium tier is constructed for busy small companies. You pay $23.99 per 30 days on the month-to-month plan or $203.88 on the annual plan, which is a 29% low cost. It accommodates all of the options of the Customary tier, plus no limits on the variety of purchasers to which you’ll be able to ship invoices.

You’re capable of join as much as 10 members of your workforce to your Billdu account at this degree. You can too arrange recurring invoices and bills. You acquire entry to the Billdu API, and a high-priority buyer assist workforce to contact everytime you need assistance.

Remaining Ideas

Billdu’s biggest power is that delivers the fundamentals with out bogging you down with too many additional options. Sadly, that’s additionally its largest weak point. Bigger companies that need to monitor invoices and bills intimately might outgrown Billdu earlier than they even begin utilizing it.

This app is a superb alternative for small companies that need assistance with monitoring invoices and bills, all whereas emphasizing your model. It’s straightforward to make use of, particularly on a cell machine, and it provides a fascinating value level in comparison with rivals that supply comparable options.

[ad_2]

Source_link