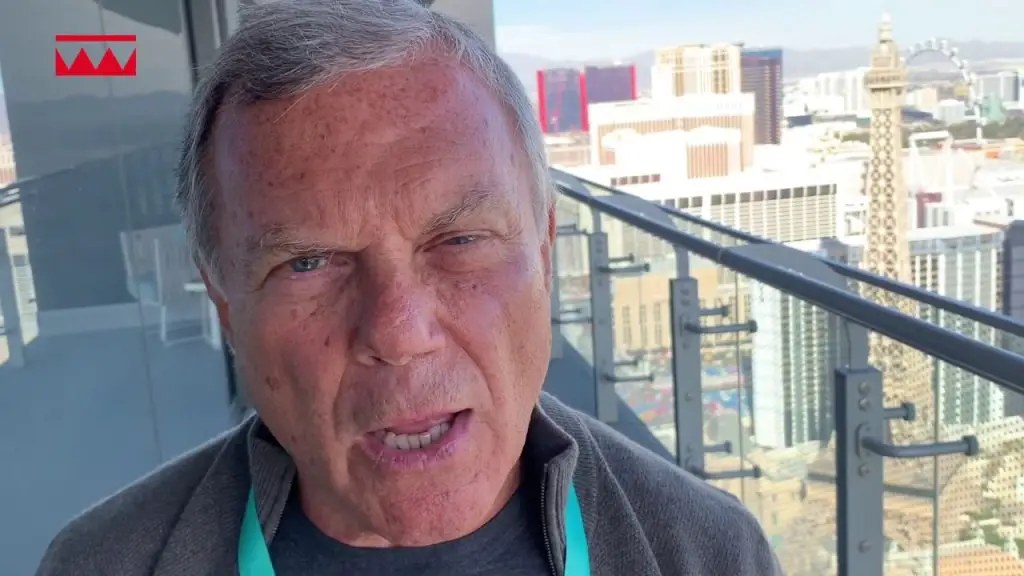

Sorrell faces one in every of his greatest challenges as S4 Capital flops once more

[ad_1]

Sir Martin Sorrell’s S4 Capital has posted one more revenue warning, saying revenues in 2023 might be decrease than final 12 months and revenue margins narrower after slower than anticipated buying and selling over the summer time.

The corporate reported a loss earlier than tax of £23.2m within the six months to June 30. Income was £517m, up simply 2.5& like-for-like..

Sorrell mentioned the corporate’s efficiency in Asia was particularly weak, blaming a sluggish restoration after the pandemic. The actually worrying admission, although, we that Media.Monks, the content material enterprise on the coronary heart of S4 Capital, fell 2.5%. S4 has minimize one other 500 jobs.

Its shares fell 25% in early London buying and selling, valuing the corporate at £400m. In July 2021 it touched £4bn, ten instances as a lot.

Speaking to the Monetary Instances, Sorrell predicted that situations would proceed to be weak into subsequent 12 months. “Shoppers are very cautious,” he mentioned. “CEOs are very bullish however it’s completely different throughout the firm.”

He could also be proper and it’s the same story on the different advert holding firms however S4 Capital was all the time speculated to be completely different, that was its level. Its concentrate on digital-only communications was speculated to imply it might defy gravity, concentrating on the rising bits of the advert financial system, unburdened by old school issues like advert companies.

Sorrell now faces one of many greatest problem of his vibrant profession. Can he handle this rambling assortment of digital and tech companies again to development and revenue? S4 employs 8500 individuals the world over with the unique founders of Media Monks nonetheless in cost (for now.)

Rivals have latched on to S4’s seemingly magical method of sooner, cheaper digital content material creation whereas there are doubts over whether or not S4’s artistic output is definitely that good. So far as development is worried, S4’s shares bumping alongside the underside make it a lot tougher to accumulate firms the place homeowners are paid partly in shares. A few of the firms S4 has purchased in its curler coaster life might be feeling bruised.

[ad_2]

Source_link