Important Insights for E-commerce Entrepreneurs

[ad_1]

- Posted in Conversion Price Optimization

Think about you’re an e-commerce entrepreneur working your on-line retailer with goals of success and profitability.

Each determination you make, and each technique you implement, is pushed by one final objective: maximizing your revenue margins. However to realize this objective, it is advisable perceive a essential idea at your corporation’s core: Value of Items Offered (COGS).

COGS is greater than only a monetary time period; it’s the important thing to unlocking the secrets and techniques of profitability within the e-commerce business. By greedy the ins and outs of COGS, you may acquire worthwhile insights into your corporation’s monetary well being, make knowledgeable pricing selections, and establish areas for price optimization.

On this article, we’ll outline the time period prices of products offered, formulation to calculate COGS, the significance of realizing COGS and selecting a way for COGS.

Let’s get began.

What’s Value Of Items Offered?

Value of Items Offered (COGS) is a basic monetary metric used to calculate the direct bills related to producing or buying items that an organization sells.

It represents the prices straight incurred in creating or acquiring the merchandise which can be subsequently offered to prospects. By understanding and successfully managing COGS, e-commerce entrepreneurs can acquire worthwhile insights into their operational effectivity, pricing methods, and general profitability.

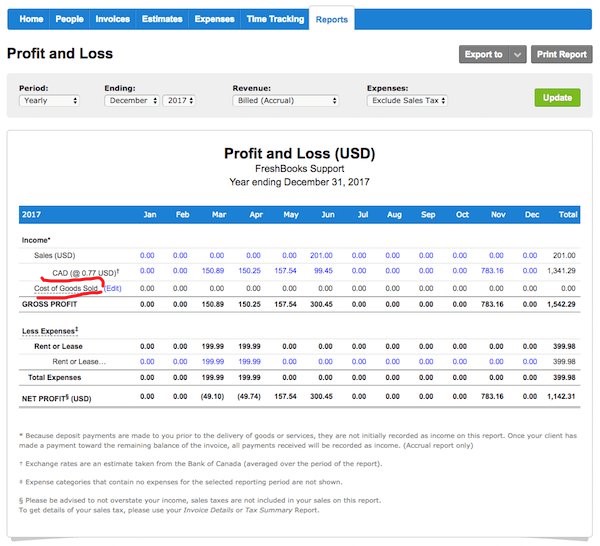

COGS is often discovered on an earnings assertion straight beneath “gross sales” or “earnings.” An earnings assertion can be referred to as a “revenue and loss assertion.” Right here’s an instance:

COGS is especially related to companies concerned in producing, manufacturing, or distributing bodily items. Whether or not you run a small-scale e-commerce retailer, a boutique enterprise, or a large-scale enterprise, COGS is an important part in evaluating your operations’ monetary well being and efficiency.

It allows entrepreneurs to find out the true price of every unit offered, offering a basis for knowledgeable decision-making in areas akin to pricing, stock administration, and product improvement.

For e-commerce companies, COGS encompasses numerous bills straight tied to creating or procuring merchandise. These prices sometimes embrace the uncooked supplies utilized in manufacturing, packaging supplies, direct labor bills, delivery and freight fees, and different bills straight related to the manufacturing course of.

Understanding and precisely monitoring these prices allow entrepreneurs to judge the profitability of their merchandise and make strategic changes to optimize their operations.

How To Calculate Value OF Items Offered?

Calculating the Value of Items Offered (COGS) is essential to precisely decide the bills straight related to the merchandise offered.

Let’s discover the essential and prolonged formulation for calculating COGS, together with their particular person elements.

Primary Formulation:

The fundamental method for calculating COGS is as follows: COGS = (Starting Stock + Further Stock) – Ending Stock.

- Starting Stock: This represents the stock worth firstly of a particular accounting interval, akin to a month or 12 months. It consists of the price of items that had been already in inventory from the earlier interval.

- Further Stock: This refers back to the worth of stock bought or produced in the course of the accounting interval being thought of. It consists of the price of new inventory that’s acquired to replenish or develop the stock.

- Ending Stock: This represents the stock worth remaining on the accounting interval’s finish. It consists of the price of items not offered and nonetheless in inventory.

Instance 1:

Let’s say an e-commerce entrepreneur begins the 12 months with $20,000 price of stock (starting stock). All year long, they buy an extra $50,000 price of stock.

On the finish of the 12 months, their remaining stock is valued at $15,000 (ending stock).

Utilizing the essential method, the COGS might be calculated as follows:

COGS = ($20,000 + $50,000) – $15,000 COGS = $70,000 – $15,000 COGS = $55,000

Which means the price of items offered in the course of the 12 months amounted to $55,000.

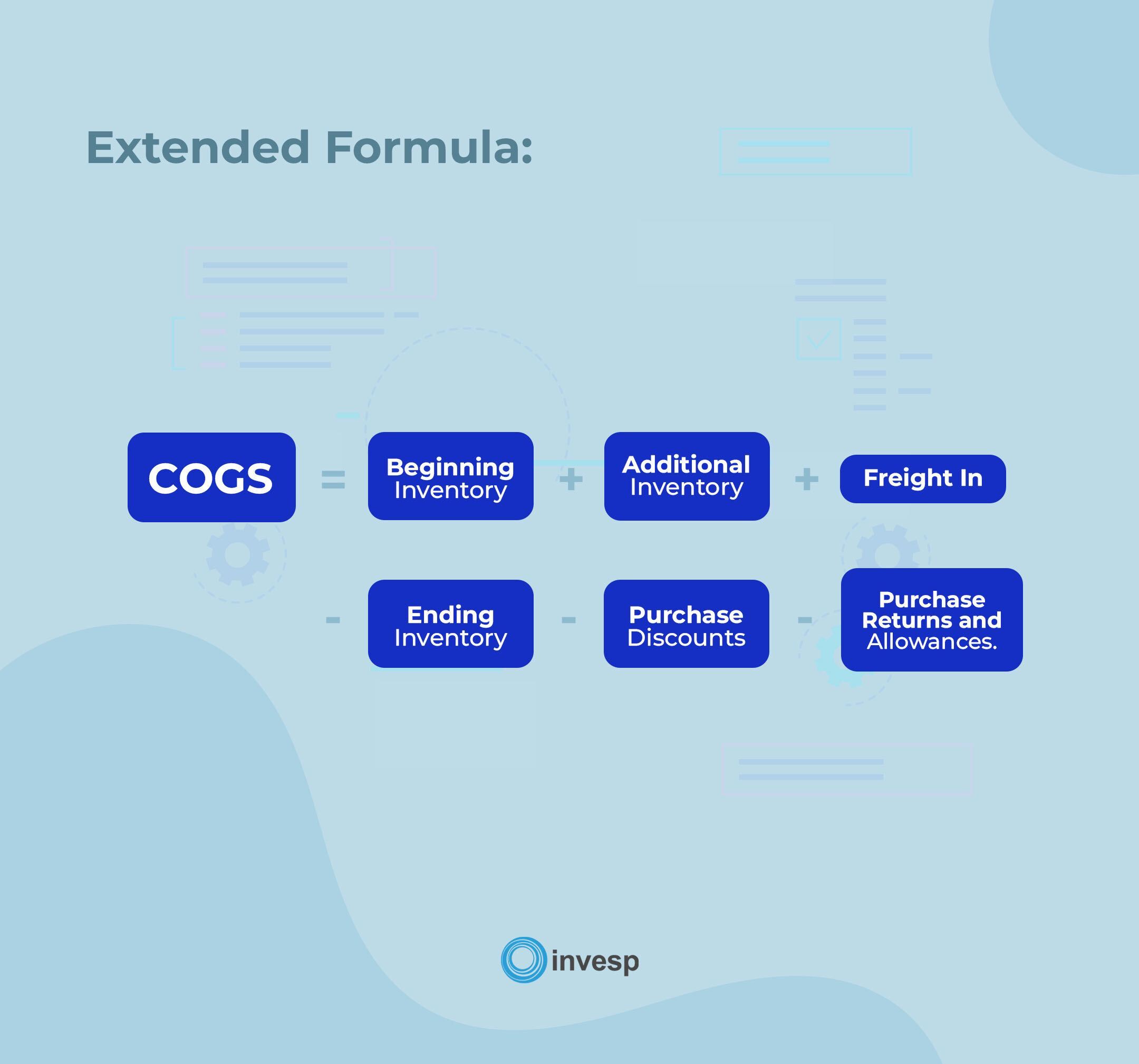

Prolonged Formulation:

The prolonged method for calculating COGS offers a extra complete view by contemplating extra elements. It’s as follows:

COGS = Starting Stock + Purchases + Freight In – Ending Stock – Buy Reductions – Buy Returns and Allowances.

- Purchases: This consists of the price of extra stock bought in the course of the accounting interval, just like the “extra stock” part within the primary method.

- Freight In: This represents the freight or delivery fees incurred when bringing the stock into the enterprise. It consists of transportation prices from suppliers to the enterprise’s location.

- Buy Reductions: This refers to any reductions obtained for early cost or quantity purchases, decreasing stock prices.

- Buy Returns and Allowances: This accounts for any returned stock or allowances granted by suppliers, decreasing stock price.

Instance 2:

Suppose an e-commerce entrepreneur begins the month with $15,000 price of stock (starting stock).

All through the month, they make purchases totaling $25,000. The freight fees related to these purchases quantity to $2,000 (freight in). On the finish of the month, the remaining stock is valued at $12,000 (ending stock).

Moreover, the entrepreneur obtained a $500 buy low cost in the course of the month.

Utilizing the prolonged method, the COGS might be calculated as follows:

COGS = $15,000 + $25,000 + $2,000 – $12,000 – $500 COGS = $30,500

Which means the price of items offered for the month equals $30,500.

By using the suitable method and contemplating all of the related elements, e-commerce entrepreneurs can precisely calculate their COGS, gaining worthwhile insights into the direct bills related to their stock.

This data serves as a basis for efficient pricing methods, stock administration, and general monetary evaluation.

Significance Of Figuring out COGS

Understanding the Value of Items Offered (COGS) is important, because it offers worthwhile insights that may positively influence numerous elements of eCommerce enterprise operations.

Let’s discover the significance of realizing COGS intimately.

1. Helps You Set the Proper Product Worth:

Figuring out the COGS allows you to set acceptable product costs, straight affecting market profitability and competitiveness.

By precisely calculating the prices related to producing or buying items, you may decide the minimal value it is advisable cost to cowl bills and generate an inexpensive revenue margin.

Setting costs too low can result in losses, whereas setting them too excessive could deter prospects.

Data of COGS empowers entrepreneurs to strike a steadiness that draws prospects, maximizes earnings, and maintains competitiveness out there.

2. Helps You Handle Your Taxes:

COGS performs a significant position in tax administration.

In lots of jurisdictions, taxes are calculated based mostly on web revenue, and COGS is an important part in figuring out the online revenue of a enterprise.

By precisely monitoring and documenting COGS, you may scale back your tax liabilities by deducting the direct prices related to their merchandise from their revenues.

This information helps you optimize your tax planning methods, decrease tax burdens, and guarantee compliance with tax rules.

3. Helps You Analyze Your Enterprise Well being:

Figuring out the COGS lets you analyze the general well being of your corporation. By evaluating COGS to the income generated, the gross revenue margin might be decided, which offers insights into the effectivity and profitability of enterprise operations.

Monitoring the pattern of COGS over time helps you establish price fluctuations, assess the influence of pricing adjustments, and make knowledgeable selections to optimize their price constructions.

Understanding the connection between COGS and income facilitates monetary evaluation, efficiency analysis, and strategic planning.

4. Helps You Detect Development Alternatives:

COGS offers worthwhile data for figuring out development alternatives inside an e-commerce enterprise.

By analyzing the profitability of particular person merchandise or product classes based mostly on their respective COGS, you may establish high-margin merchandise and give attention to increasing these segments.

Moreover, understanding the COGS related to completely different channels, buyer segments, or geographic areas lets you establish potential development areas and allocate sources strategically.

This information allows you to capitalize on alternatives for enterprise growth.

5. Helps Optimize Direct and Oblique Prices:

Figuring out the COGS allows you to optimize direct and oblique prices related to operations.

By analyzing the elements of COGS, akin to uncooked materials prices, packaging bills, and delivery fees, you may establish areas the place cost-saving measures might be carried out.

This information helps streamline procurement processes, negotiate favorable phrases with suppliers, eradicate wasteful practices, and improve general operational effectivity.

By optimizing direct and oblique prices, you may enhance revenue margins, reinvest within the enterprise, or cross on the advantages to prospects by way of aggressive pricing.

6. Helps You Decide Web Revenue:

COGS is a key think about figuring out the online revenue of an e-commerce enterprise. By deducting the COGS from the income generated, you may calculate the gross revenue of your corporation.

This determine represents the remaining quantity after accounting for the direct prices of the merchandise offered. From the gross revenue, you may additional deduct working bills, taxes, and different prices to reach on the web revenue.

Understanding the connection between COGS and web revenue helps you consider the monetary efficiency of your corporation, make knowledgeable selections, and develop methods to enhance profitability.

Selecting a Costing Methodology for COGS

When calculating the Value of Items Offered (COGS), there are a number of costing strategies to select from.

Every methodology has benefits and downsides, and the choice relies on the particular wants and traits of the enterprise.

Let’s discover 4 generally used costing strategies: FIFO, LIFO, MAC, and Particular Identification.

1. FIFO (First-In, First-Out)

FIFO is a costing methodology the place the primary stock objects bought or produced are thought of the primary ones offered.

This methodology assumes that the oldest stock is offered first whereas the newest stock stays in inventory.

Some great benefits of FIFO embrace:

- Displays the pure move of stock and is intuitive to grasp.

- Usually ends in a extra correct illustration of the present worth of stock.

- Minimizes the chance of stock obsolescence as older stock is offered first.

Nevertheless, FIFO additionally has disadvantages:

- During times of inflation, it might end in increased web earnings and taxes paid, as the price of older stock is decrease than the alternative price.

- It might not precisely replicate the precise bodily move of products in sure industries or conditions.

2. LIFO (Final-In, First-Out)

LIFO is a costing methodology the place the newest stock objects bought or produced are thought of the primary ones offered.

This methodology assumes that the most recent stock is offered first whereas the oldest stock stays in inventory.

Some great benefits of LIFO embrace:

- Displays the influence of inflation by matching the upper present alternative prices with income.

- It can lead to decrease taxable earnings during times of inflation.

Nevertheless, LIFO additionally has disadvantages:

- It doesn’t replicate the precise move of stock, which can be a priority for sure industries.

- This will likely result in inaccurate stock valuation during times of deflation.

- It might probably create problems when monitoring and managing stock if not finished meticulously.

3. MAC (Shifting Common Value)

MAC is a costing methodology the place the typical price of all models in stock is calculated and utilized to the price of items offered.

Some great benefits of MAC embrace:

- Smooths out fluctuations in stock price by contemplating the typical price of all models.

- Gives a extra balanced and secure illustration of the price of items offered.

- Minimizes the influence of value fluctuations out there.

Nevertheless, MAC additionally has disadvantages:

- It might not precisely replicate the present alternative price of stock.

- It can lead to increased web earnings during times of inflation in comparison with FIFO, as older, lower-cost stock is just not totally mirrored.

4. Particular Identification:

Particular Identification is a costing methodology generally utilized in industries the place every merchandise might be recognized and assigned a particular price.

This methodology includes monitoring the price of every merchandise offered individually.

Some great benefits of Particular Identification embrace:

- Gives probably the most correct valuation of COGS because it matches the precise price of every merchandise offered.

- Excellent for industries with distinctive or high-value objects, akin to luxurious items or personalized merchandise.

Nevertheless, Particular Identification additionally has disadvantages:

- Requires meticulous record-keeping and monitoring of particular person stock objects, which might be time-consuming and sophisticated.

- It is probably not sensible for industries with many low-value objects or quickly altering stock.

Contemplating the benefits and downsides of those costing strategies, the MAC (Shifting Common Value) methodology typically emerges as the popular choice for a lot of e-commerce companies.

MAC balances accuracy and ease, making it one of the best of each worlds.

It smooths out price fluctuations, offers a complete image of prices, and is simple to implement and handle.

Furthermore, averaging prices permits entrepreneurs to keep up constant COGS, decreasing the influence of market fluctuations and offering a extra secure monetary image.

Deciphering Your Enterprise COGS

The Value of Items Offered (COGS) performs a vital position in deciphering and analyzing the operational effectivity of an e-commerce enterprise.

Listed here are some methods it could possibly assist:

1. Figuring out Operational Effectivity:

COGS serves as a key metric for evaluating the operational effectivity of a enterprise. By analyzing COGS in relation to income, you may calculate the gross revenue margin, which signifies the proportion of income retained after accounting for direct manufacturing prices.

The next gross revenue margin suggests a extra environment friendly operation, as a bigger portion of income is obtainable to cowl oblique prices and generate web revenue.

Monitoring the pattern of COGS over time lets you assess the effectivity of their manufacturing processes, establish cost-saving alternatives, and make data-driven selections to enhance operational effectivity.

2. Decreasing Operational Prices:

COGS evaluation offers worthwhile insights into areas the place operational prices might be diminished.

By figuring out the elements of COGS, akin to labor prices, machine idle time, or different manufacturing bills, you may implement methods to reduce these prices.

For instance, you may decrease manufacturing prices and enhance general effectivity by optimizing staffing ranges, streamlining manufacturing processes, or leveraging expertise to scale back machine idle time.

Moreover, COGS evaluation allows enterprise homeowners to establish and implement new enterprise ways, akin to sourcing supplies from cheaper suppliers or renegotiating contracts, to scale back bills and improve profitability.

3. Minimizing Theft and Product Injury

COGS evaluation may help you deal with challenges associated to theft and product harm, which may considerably influence profitability.

By monitoring COGS and evaluating it to gross sales income, you may establish any discrepancies that will point out losses as a consequence of theft or harm.

With this data, you may implement acceptable safety measures, akin to surveillance methods, stock management procedures, or worker coaching applications, to reduce theft dangers and safeguard your merchandise.

Moreover, by understanding the monetary influence of product harm by way of COGS evaluation, you may prioritize investments in high quality management, packaging enhancements, or delivery strategies that scale back the chance of product harm and related prices.

4. Avoiding Overstocking and Final-Minute Orders:

COGS evaluation may help you strike a steadiness between stocking sufficient stock to satisfy buyer demand and avoiding extreme stock ranges that end in elevated warehousing and storage prices.

You possibly can optimize stock administration practices by understanding the connection between COGS and stock turnover.

Overstocking results in increased carrying prices, potential product obsolescence, and elevated threat of losses.

Conversely, inadequate inventory ranges can lead to last-minute rush orders, elevated delivery prices, and potential lack of income as a consequence of unfulfilled buyer calls for.

COGS evaluation offers you with insights into stock ranges, enabling you to make knowledgeable selections on procurement, gross sales forecasting, and stock optimization to realize higher operational effectivity and price management.

Ideas for Enhancing Operational Effectivity Based mostly on COGS Evaluation

1. Optimize Provide Chain Administration:

Analyze the elements of COGS associated to the procurement and transportation of products. Search for alternatives to optimize your provide chain, akin to negotiating higher phrases with suppliers, consolidating shipments to scale back transportation prices, or implementing just-in-time stock administration to reduce carrying prices.

2. Streamline Manufacturing Processes:

Study the particular manufacturing prices inside COGS and establish areas the place processes might be streamlined. Search for methods to scale back waste, enhance workflow, or automate repetitive duties. Implement lean manufacturing rules or put money into expertise options that improve effectivity and scale back manufacturing prices.

3. Implement High quality Management Measures:

Assessment COGS associated to product defects, returns, or buyer complaints. Implement sturdy high quality management measures to reduce the incidence of defects and be sure that merchandise meet buyer expectations. This helps scale back the prices related to rework, returns, and buyer dissatisfaction.

4. Analyze Pricing Methods:

Make the most of COGS evaluation to judge the profitability of various merchandise or product classes. Establish low-margin or high-cost objects and assess whether or not changes in pricing or sourcing might be made to enhance profitability. Contemplate methods akin to worth engineering, product bundling, or negotiating higher pricing with suppliers to boost margins.

5. Optimize Stock Administration:

Leverage COGS evaluation to fine-tune your stock administration practices. Use information on stock turnover, carrying prices, and demand patterns to optimize reorder factors, security inventory ranges, and lead instances. Implement stock administration methods or software program to automate and streamline the method, decreasing prices related to overstocking or stockouts.

6. Put money into Worker Coaching and Improvement:

Study labor prices inside COGS and establish alternatives to boost worker productiveness and expertise. Present coaching applications specializing in bettering effectivity, time administration, and job-specific expertise. Interact staff in steady enchancment initiatives and empower them to contribute concepts for course of optimization and price discount.

7. Monitor and Management Overhead Prices:

Whereas COGS primarily focuses on direct prices, overhead prices additionally influence general operational effectivity. Analyze and monitor bills akin to lease, utilities, administrative prices, and advertising expenditures. Establish areas the place cost-saving measures might be carried out with out compromising enterprise operations or buyer expertise.

COGS Metrics And Ratios You Ought to Know

Three key metrics and ratios are associated to the Value of Items Offered (COGS).

Let’s discover them and see what they imply for any eCommerce enterprise.

1. COGS Ratio:

The COGS ratio measures the proportion of an organization’s income that’s consumed by the Value of Items Offered.

It’s calculated by dividing COGS by complete income and multiplying the outcome by 100 to precise it as a proportion.

The method for the COGS ratio is:

COGS Ratio = (COGS / Whole Income) * 100

The COGS ratio signifies the effectivity of the enterprise’s price administration and manufacturing processes.

The next COGS ratio signifies {that a} bigger portion of income is used to cowl the prices straight related to producing or buying items.

This will likely recommend that the enterprise has increased manufacturing prices, inefficient stock administration, or pricing methods that influence profitability.

Alternatively, a decrease COGS ratio implies better price effectivity and improved profitability.

Analyzing the COGS ratio helps enterprise homeowners establish developments and make knowledgeable selections relating to pricing methods, sourcing options, or course of optimization to raised steadiness income and prices.

2. Stock Turnover:

Stock turnover is a metric that measures how effectively a enterprise manages its stock by evaluating the variety of instances stock is offered and changed inside a given interval.

It’s calculated by dividing the COGS by the typical stock worth.

The method for stock turnover is:

Stock Turnover = COGS / Common Stock

The stock turnover signifies the pace at which stock is transformed into gross sales and replenished.

A excessive stock turnover means that items are offered shortly, minimizing the carrying prices related to stock.

It displays environment friendly stock administration, efficient gross sales methods, and correct demand forecasting.

Conversely, a low stock turnover signifies slower gross sales or extra stock, probably resulting in elevated carrying prices, obsolescence, or the chance of losses as a consequence of product deterioration.

By monitoring stock turnover, e-commerce entrepreneurs can optimize their stock ranges, enhance money move, scale back storage prices, and make sure the availability of the proper merchandise on the proper time.

3. Gross Revenue Margin:

The gross revenue margin measures the profitability of a enterprise’s core operations after deducting the Value of Items Offered from income.

It represents the proportion of income that continues to be after accounting for the direct prices related to producing or buying items.

The method for the gross revenue margin is:

Gross Revenue Margin = (Whole Income – COGS) / Whole Income) * 100

The gross revenue margin signifies the effectivity of a enterprise in producing earnings from its core operations.

The next gross revenue margin signifies higher profitability and the flexibility to cowl oblique bills, akin to advertising, administration, and overhead prices.

It displays the enterprise’s pricing technique, price management, and aggressive positioning. Conversely, a decrease gross revenue margin suggests increased manufacturing prices or pricing pressures, which can require sourcing, pricing, or price administration changes.

Analyzing the gross revenue margin allows entrepreneurs to evaluate the profitability of their services or products, establish alternatives for price discount, and consider the effectiveness of their pricing methods.

Closing Ideas

As I mentioned within the introduction, COGS is the important thing to unlocking profitability for any eCommerce enterprise.

And to realize that, this text has proven you calculate the COGS method (primary and prolonged), direct prices incurred, COGS ratio, and different essential metrics.

For those who apply all that you just learn right here, you need to be capable to interpret your corporation COGS, see profitability and plug all leaks and damages in your corporation income.

[ad_2]

Source_link